Credit Card is an online payment card that allow – cardholder to borrow money from card issuer to pay for goods and services. Cardholder is then required to repay borrowed money, plus interest, to card issuer.

Transferring money from credit card to bank account can be convenient way to pay bills, make purchases, or simply consolidate your trasanction. There are different ways to do this, and easy method for you will depend on your individual need and preference.

In this blog post, we will discuss 10 different valuable ways to transfer money from credit card to bank account. We will also provide tips on how to choose the best method for you and how to avoid fee.

1. Online Banking

One of the easiest ways to transfer money from credit card to bank account is through online banking. Most banks offer this service, and it is usually free to use.

To transfer money using online banking, you will need to log in your bank’s website and go “Transfer Funds” section. You will then need to select the credit card you want to transfer money from and the bank account you want to transfer it to. Enter the amount you want to transfer and click “Submit.”

2. Phone Banking

If you don`t have access or enable to online banking, you can also transfer money from credit card to bank account by phone. Simply call your credit card company and ask to customer service representative.

The representative will ask you for some information, such as your credit card number, amount you want to transfer, and bank account number you want to transfer it to. They will then process transfer for you.

3. ATM

If you have need to transfer money from credit card to bank account quickly and easy way, you can use an ATM. However, keep in mind that ATM transfers usually come with fee.

To transfer money using an ATM, you will need to insert your credit card and enter your PIN. Then, select “Transfer Fund” option and follow prompts/instruction. Enter the amount you want to transfer and bank account number you want to transfer it to. The ATM will then dispense cash or credit your bank account.

4. Bill Pay

If you have recurring bill status that you pay with your credit card, you can set up bill pay transfer. This will give you to automatically transfer money from your credit card to your bank account each month to pay the bill. HDFC Credit Card Absolutely Free ! Apply Link

To set up bill pay transfer, you will need to log in to your credit card company’s website or call customer service. You will then need to provide biller’s information, such as their name, address, and account number in correctly form. You will also need to specify the amount you want to transfer each month.

5. PayPal

PayPal is an international popular online payment service that allow you to send and receive money from anyone with valid email address. You can use PayPal to transfer money from your credit card to your bank account.

To transfer money using PayPal, you will need to create a valid PayPal account and link your credit card and bank account. Then, you can simply send money to yourself from your credit card to your bank account.

6. Apple Pay

Apple Pay is a mobile payment service that offer you to transfer money from your credit card to personal bank account. To do this, you will need to create an Apple Pay account and link your credit card in valid way to your account. You can then transfer money in easy from your credit card to your bank account by opening the Apple Pay app and selecting the “Transfer Money” option.

7. RTGS

Real-Time Gross Settlement (RTGS) is a faster, timely and more secure method of transferring money between bank account in India. To transfer money from your credit card to your bank account using RTGS, you will need to provide your credit card company with correct RTGS details of your bank account.

8. NEFT

National Electronic Funds Transfer (NEFT) is a popular & secure method of transferring money between bank account in India. To transfer money from your credit card to your bank account using NEFT, you will need to provide your valid credit card company with genuine NEFT details of your bank account.

9. Venmo

Venmo is another popular online payment service that is similar to PayPal , you can say it is alternative option of paypal. You can use Venmo to transfer money from your credit card to your bank account.

To transfer money using Venmo, you will need to create Venmo account and link your credit card and bank account. Then, you can simply send money to yourself from your credit card to your bank account.

10. Google Pay

Google Pay is a mobile payment service that give you to send and receive money from anyone with valid Google account. You can use Google Pay to transfer money from your credit card to your bank account.

To transfer money using Google Pay, you will need to create Google Pay account and link your credit card and bank account. Then, you can simply send money to yourself from your credit card to your bank. This time, Google Pay is very popular online trasaction app.

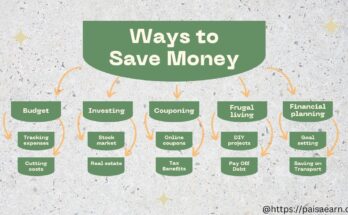

Tips for Choosing the Best Method

Here are a few things to consider when choosing a method:

- Convenience: How easy is it to use the method? Do you have access to the necessary tools or resources?

- Cost: How much does the method cost? Are there any hidden fees?

- Speed: How quickly will the transfer be processed? Do you need the money to be available immediately?

- Security: How secure is the method? Is your information protected?

How to Avoid Fees

When transferring money from credit card to bank account, it is important to be aware of potential fee include. Some method may charge fee for transaction, and some bank may charge fee for using your credit card to make transfer.

To avoid fees, it is best to use method that does not charge fee. You can also check with your bank to see if they offer any fee-free methods of transferring money.