The Debt Trap Puzzle

While BNPL offer several advantages- there is a growing concern about its potential to ensnare individual into a cycle of debt. Many consumer may overlook the long-term implication of this payment method and underestimate their ability to make timely payment. Failure to repay installment on time can lead to high interest rate and fees- putting people at risk of falling into a debt trap.

Hidden Cost and Late Payment Penalty

Some BNPL platform offer interest-free periods- it’s essential to read the fine print. If payment are not made on time, consumer may incur hefty penalty and high interest rates. Some platform charge late payment fees- which can accumulate and make it even more challenging to clear the outstanding balance. It’s crucial for consumer to carefully review- terms and conditions, before opting for a BNPL service to avoid any surprises later.

Overspending and Impulse Buying

Another significant concern associated with BNPL is the potential for overspending and impulse buying. The deferred payment option can easily entice individual to make purchase, they wouldn’t otherwise consider. Without proper budgeting and financial discipline- consumer may find accumulating debt, that become increasingly difficult to manage in the long run.

Responsible Use of Buy Now Pay Later

While there are risk associated with BNPL, it can be a helpful facility when used responsibly. Here are some tips to ensure a positive BNPL experience:

- Plan your purchase: Before making a purchase, evaluate whether it is a necessity or a want. Consider your financial situation and whether you can comfortably afford the installments.

- Read the term and conditions: Familiarize yourself with the interest rates, late payment fees, and penalties associated with the BNPL service. Understanding the terms will help you make informed decisions.

- Set reminder: Missing a payment can be costly. Set up reminders to ensure timely repayments and avoid unnecessary fees.

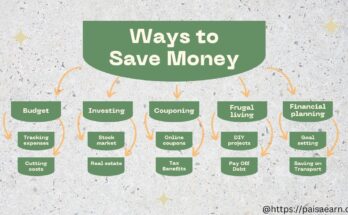

- Budget and track your expenses: Incorporate BNPL installments into your budget and track your spending regularly to avoid overspending and accumulating excessive debt.

Conclusion

Buy Now Pay Later can be convenient facility to manage their expenses without immediate payment. It offers flexibility, convenience and easy access to credit. However- it’s crucial to be mindful of potential pitfall and risks associated with payment method. Responsible use, careful budgeting and understanding- term and conditions are key to ensure, that BNPL remain a helpful facility rather than leading to debt trap. Make informed choice and financial discipline to leverage- the benefits of BNPL without falling into unnecessary debt burden.