Candlestick charts are a type of technical analysis tool, that is used by traders to identify price pattern & trends. Candlestick chart are one of the most popular technical analysis tools available and they are used by traders of all experience level.

Candlestick charts can be used to trade any financial instrument- including stocks, currency, commodities and indice. They are particularly useful for trading– short-term price movements, as they can provide traders with a lot of information about the market sentiment in a very short period of time.

What are Candlestick Charts?

Candlestick chart are a type of ‘price chart’ that show the open, high, low and close price of security over a specified period of time. They are typically displayed in vertical format- with each candlestick representing a single time period.

The body of the candlestick represent- difference between open and close price. If the close price is higher than the open price, candlestick is green or white. If close price is lower than open price, the candlestick is red or black.

The upper and lower wick of the candlestick represent the high and low price for the period. The longer the wicks, the greater the range of price movement during the period.

- How To Earn Money From Linkedin Followers

- Real Ways to Make Money from Home for Free

- How to Earn Money from Instagram through Post

- How to Earn Money from Google Play Store: Monetize Your Apps

- Online Work And Earn Money Daily: 6 Work From Home Jobs

Popular Candlestick Patterns

There are many different candlestick patterns that traders can use to identify price patterns and trends. Some of the most common candlestick patterns include:

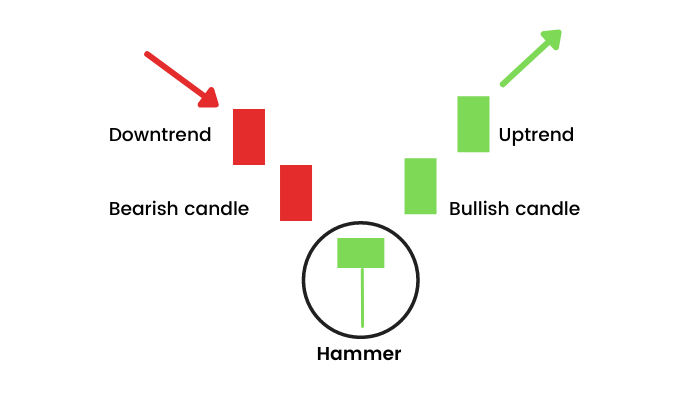

Hammer

A hammer candlestick has small body and long lower wick. It is a bullish reversal pattern, that indicates- the buyers are taking control of the market.

Inverted Hammer

An inverted hammer candlestick has small body and long upper wick. It is a bearish reversal pattern, that suggests that seller are stepping in and taking control of the market.

Hanging Man

A hanging man candlestick has small body and long upper wick. It is a bearish reversal pattern, that indicates – the sellers are taking control of the market.

Bullish Engulfing

A bullish engulfing candlestick is green candle that completely engulf- the previous red candle. It is a bullish reversal pattern that indicates- that the buyer are taking control of the market.

Bearish Engulfing

A bearish engulfing candlestick is red candle that completely engulf- the previous green candle. It is a bearish reversal pattern that, indicates that- the seller are taking control of the market.

Doji

A doji candle has small body and very short or no wicks. It is considered to be neutral pattern, as it indicate, that buyers and seller are evenly matched.

Morning Star

A morning star candlestick pattern is three-candlestick pattern that consist of black candlestick, white candlestick with small body and black candlestick with long upper wick. It is a bullish reversal pattern that suggest, that buyer are stepping in and taking control of the market.

Evening Star

An evening star candlestick pattern is three-candlestick pattern, that consist of white candlestick, black candlestick with a small body and white candlestick with a long lower wick. It is a bearish reversal pattern, that suggest that sellers are stepping in and taking control of the market.