Curious about the best indicator for option trading? You are not alone. In today’s fast-paced market- finding the right tools is crucial, but finding the right indicators can make all the difference.

In this guide- we will explore top indicators, sharing insights and tips to help you trade smarter, reduce risk and achieve your financial goals.

Let’s discover the tools that can transform your trading experience.

Understanding Option Trading

Option trading can be an awesome online business for investor. It involves buying and selling option contract- which give trader the right, but not the obligation, to buy or sell an underlying asset at a predetermined price before a specific date.

Understanding the dynamics of option trading is crucial for making informed decision.

To navigate this effectively- traders often rely on various indicators. These indicators- help in analyzing market trends, predicting price movement and ultimately making better trading decision.

What Makes a Good Indicator?

A good indicator should provide clear signals, be easy to interpret and have a proven track record of reliability.

Here are some key characteristics to look for in an effective trading indicator:

- Simplicity: The indicator should be straightforward to understand and use.

- Relevance: It should be applicable to the specific market condition and asset being traded.

- Timeliness: The indicator should provide signals in a timely manner to allow for quick decision-making.

- Historical Performance: A good indicator should have a history of accuracy in predicting market movement.

The Best Indicator for Option Trading

When it comes to option trading- one of the best indicators is the Implied Volatility (IV). Implied volatility reflects the market’s expectation of future volatility and is a critical factor in option pricing.

Here’s why IV is considered the best indicator for option trading:

Why Implied Volatility?

Market Sentiment

IV provides insights into how trader feel about the future volatility of an asset. A high IV indicates that traders expect significant price movement, while a low IV suggest stability.

Pricing Option

Option prices are heavily influenced by IV. Understanding IV can help traders identify whether options are overpriced or underpriced.

Risk Assessment

By analyzing IV, traders can assess the risk associated with a particular option. This helps in making more informed trading decision.

How to Analyze Implied Volatility

Historical Comparison

Compare current IV level with historical average to gauge whether options are relatively cheap or expensive.

IV Rank and Percentile

Use IV rank and percentile to understand where the current IV stands compared to its historical range. This can help in identifying potential trading opportunities.

Other Useful Indicators for Option Trading

While Implied Volatility is a standout indicator, several other indicators can complement your trading strategy:

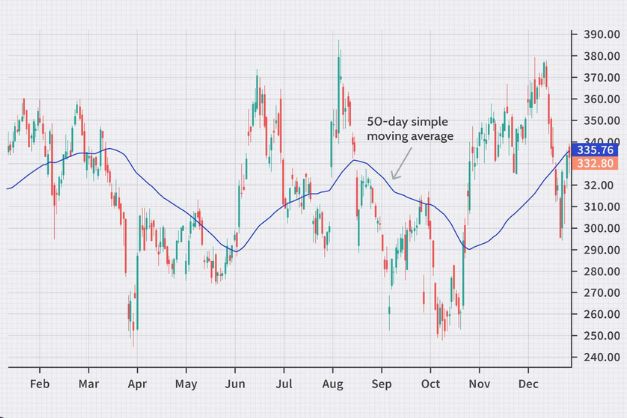

1. Moving Average

Moving average smooth out price data to identify trends over a specific period. They can help traders determine entry and exit points.

2. Relative Strength Index (RSI)

RSI measure the speed and change of price movements. It range from 0 to 100 and can indicate overbought or oversold condition.

3. Bollinger Band

Bollinger Band consist of a middle band (SMA) and two outer bands that represent volatility. They can help traders identify potential price breakout.

4. Volume

Analyzing trading volume can provide insights into the strength of a price movement. High volume often confirm a trend, while low volume may indicate a lack of conviction.

How to Use Indicators Effectively

To maximize the effectiveness of indicators in option trading, consider the following strategies:

- Combine Indicators: Use multiple indicators to confirm signals. For example- combine Implied Volatility with RSI to validate potential trade.

- Backtesting: Test your strategies using historical data to see how well your indicators would have performed in the past.

- Stay Informed: Keep up with market news and event that may impact volatility and market sentiment. This can help you interpret your indicators more effectively.

Conclusion

In summary, the best indicator for option trading is Implied Volatility, as it provides valuable insights into market expectation and options pricing.

By understanding and utilizing IV, along with other complementary indicators, traders can enhance their decision-making process and improve their chances of success in the options market.

Engage with your trading community, share your experience and continue learning about the best practice in option trading. Remember- the right indicators can make a significant difference in your trading journey.